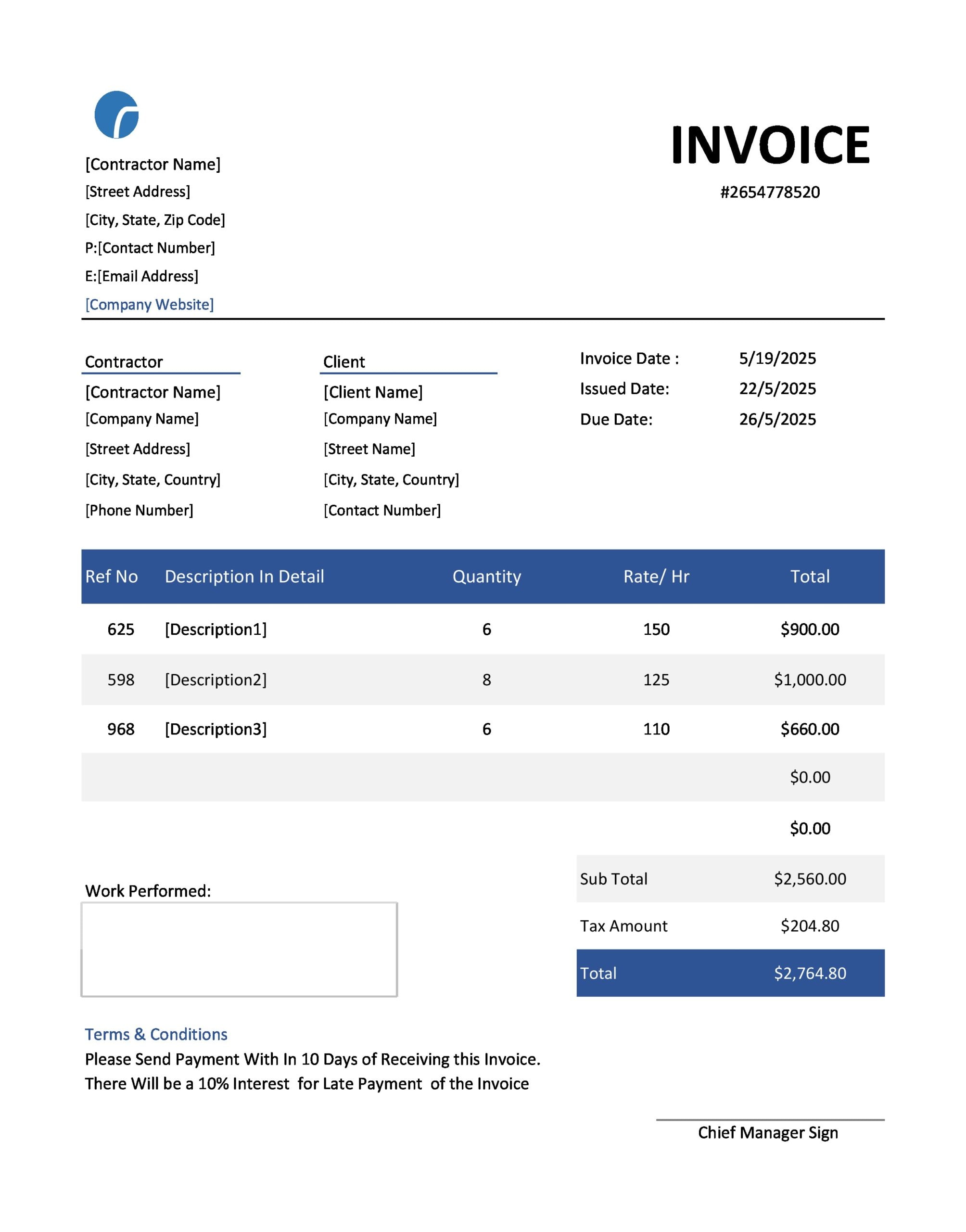

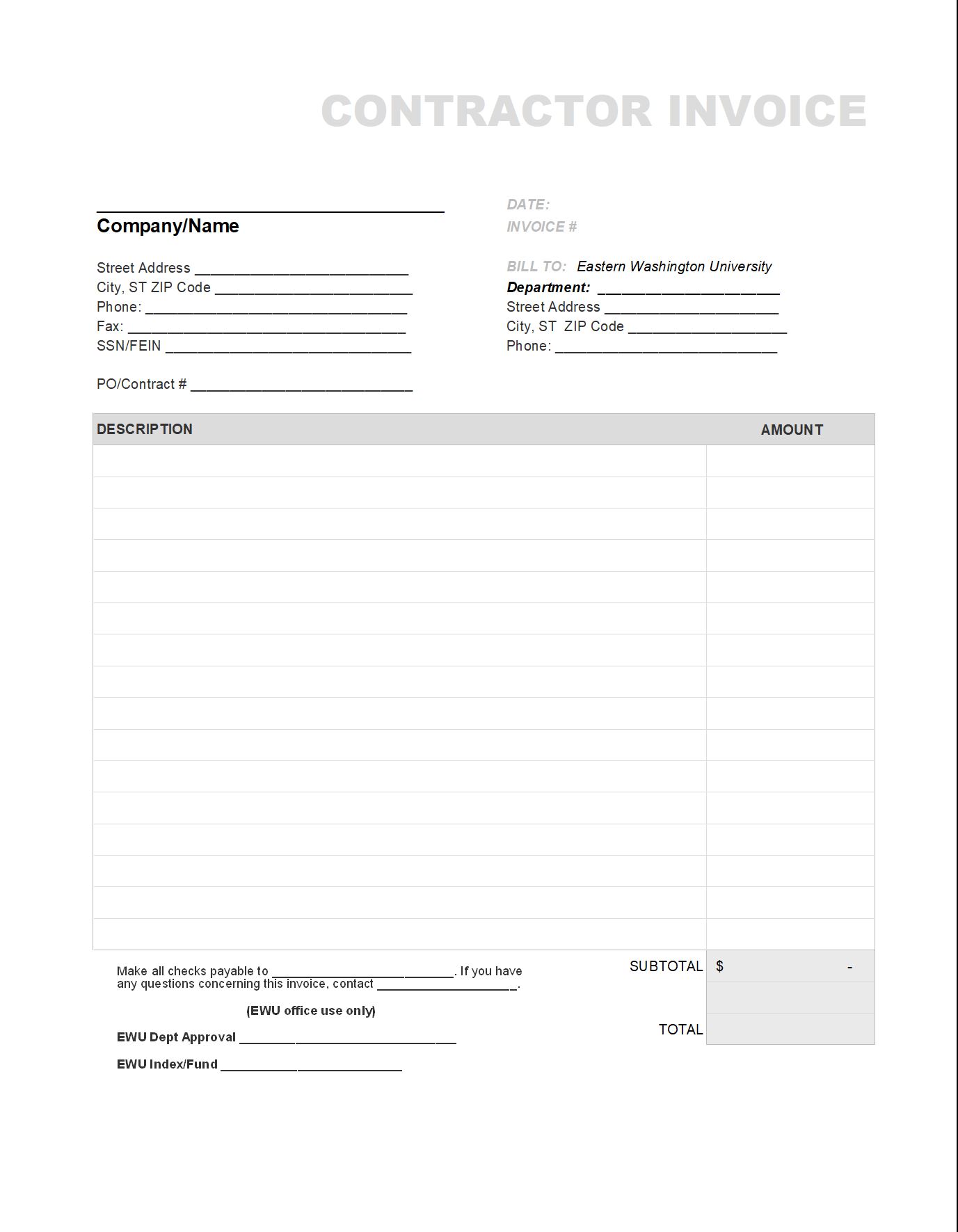

Independent Contractor Invoice

An invoice number the dates covered by the invoice a summary of the work performed and any other information or details in. The independent contractor agreement is there to hold all parties accountable for.

Free Contractor Invoice Template Download Now Freshbooks France

Contact a professional organization or trade association for your field.

. Everything from landscaping electrical work renovations plumbing etc. The invoice generator will calculate the total balance due from the line items you entered in boxes six and seven. There are a variety of Excel invoice templates to choose from including business invoice templates and templates that use formulas to automatically calculate taxes.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client including. Updated June 23 2022. A unique invoice number.

Select Banking then select Write Checks to start the direct deposit. Select the Bank Account dropdown and select the checking account you use to pay contractors. Contractor shall be paid within a reasonable time after Contractor submits an invoice to Client.

Invoice Identify the document with the word invoice to differentiate from a quote credit note or receipt. In other words ask for a detailed agreement and post-work receipt and make both absolute dealbreakers. An Independent Contractor Agreement can also be known as a.

The contract signed between a contractor and their client is known as an Independent Contractor Agreement. On the plus side home office expenses are tax-deductible. Whether you are an employee or a contractor depends on many different factors.

Essentially its a written record of the purchase agreement. Independent contractors work for themselves and are their own boss. You can do this yourself using a word processor or Excel but you could also use one of our free invoice templates above.

The employee or contractor may enter their information and hours worked at the end of their shift and the company or hiring individual may calculate total hours and pay to properly compensate the employee or contractor. 28 Independent Contractor Invoice Templates FREE October 28 2020 6 Mins Read. Ask other Independent Contractors what they charge.

If it is still unclear whether a worker is an employee or an independent contractor after reviewing the three categories of evidence then Form SS-8 Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding PDF can be filed with the IRS. The cost of hiring a photographer varies depending on services requested experience and any follow-up photo editing services. Select the Pay to the Order of.

Contractor in the following manner. The form may be filed by either the business or the worker. Contractor shall be responsible for all expenses incurred while performing services under this Agreement.

The number must be unique to each invoice without duplicates for clear identification and you must keep a record of the numbers and references used. Before hiring a contractor for any projectlarge or smallget specifics and promises down as a legitimate work contract. Being labeled an independent contractor being required to sign an agreement stating that one is an independent contractor or being paid as an independent contractor that is without payroll deductions and with income reported by an IRS Form 1099 rather than a W-2 is not what determines employment status.

_____ _____ _____ Contractor shall be paid within a reasonable time after Contractor submits an invoice to Client. The typical time frame for payment is 15 to 30 days. But you need to consider a range of factors when deciding whether.

An invoice is a document a contractor sub or supplier sends to their customer when payment is owed for work performed. The first step is to put your invoice together. Talk to potential clients attend trade shows and business conventions speak to your existing network.

An invoice number the dates covered by the invoice and a summary of the work performed. A photography contract is between a photographer that is hired by a client to take professional photos. Typically an independent contractor will first send you an invoice which will specify certain payment terms.

Such a situation allows independent contractors to have a more flexible schedule. Sometimes you will have an opportunity to decline a certain project or task but this will depend on some other factors such as whether or not you have a signed contract with the employer. An independent contractor works on a per-project basis or as the employer requires them to.

Invoicing is what keeps the cash flowing. Make your invoice look professional. An independent contractor agreement is a legally binding document between the contractor and client that sets forth the terms and conditions for which work is to be completed.

The invoice should include the following. People such as doctors dentists veterinarians lawyers accountants contractors subcontractors public stenographers or auctioneers who are in an independent trade business or profession in which they offer their services to the general public are generally independent contractors. Review the definition of an independent contractor and related tax obligations.

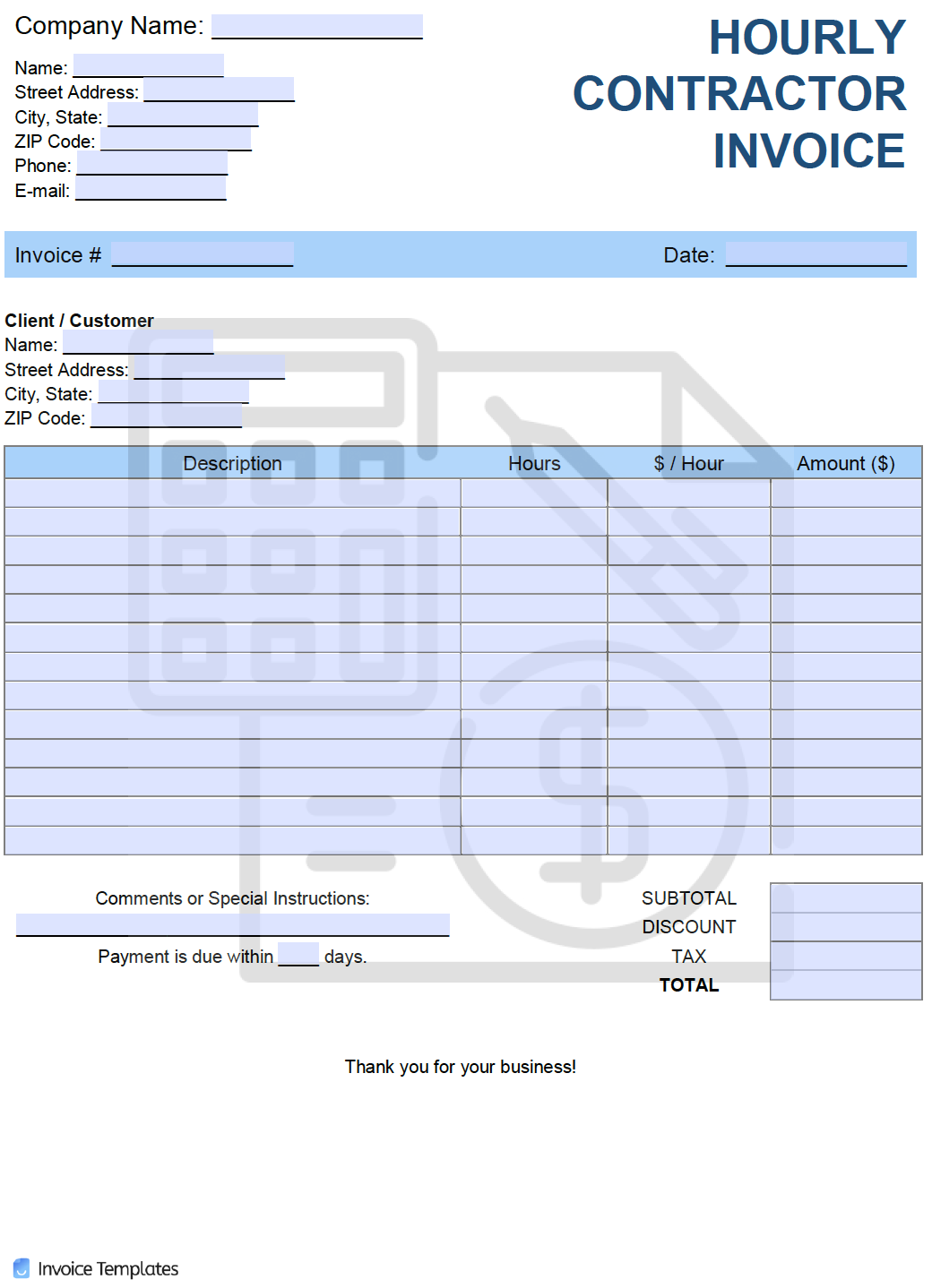

The terms and conditions of payment on an invoice is the part most frequently overlooked. To filter the template results click on the search bar in the upper right-hand corner of the page type invoice and hit enter to search. An hourly invoice is a document that tracks hours worked by an employee or contractor being paid an hourly wage.

We would like to show you a description here but the site wont allow us. They may be able to give you good information on what other Independent Contractors are charging in your area. Invoices establish a payment obligation thereby creating an account receivable.

Things employers should know How to pay an independent contractor. A typical construction invoice will. Employees work in someone elses business the employer controls how where and when they do their work and pays them a wage.

Unlike employee wages which youll handle through your payroll you pay your independent contractors like you would any other kind of supplier via your accounts payable system. Set a deadline so the client knows how much time they have to pay the contractor after receiving an invoice. The invoice should include the following.

Share on Facebook Share on Twitter Pinterest Email. This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor. The standard payment terms can vary by industry your companys policy or previous history.

As an independent contractor youll have to pay your own taxes which include Social Security and Medicare tax. When youre ready to pay an independent contractor using direct deposit. Choose Your Invoice Template.

A bid or a proposal isnt a contract and they rarely include enough details to protect you if issues arise later. As an independent contractor you would have a lot on your hands because you run a business that provides essential services. Youll need to keep track of your own hours that youve worked as youll usually have to submit an invoice to the company in order to be paid.

Before paying your contractor make sure you update to the latest version of QuickBooks Desktop. Terms Conditions and Payment Instructions. Updated July 04 2022.

Free Invoice Template Samples Generator Legal Templates

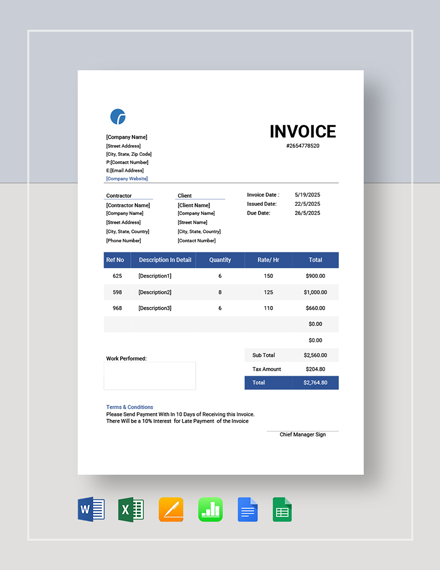

Independent Contractor 1099 Invoice Template

Hourly Rate Hr Invoice Template Pdf Word Excel

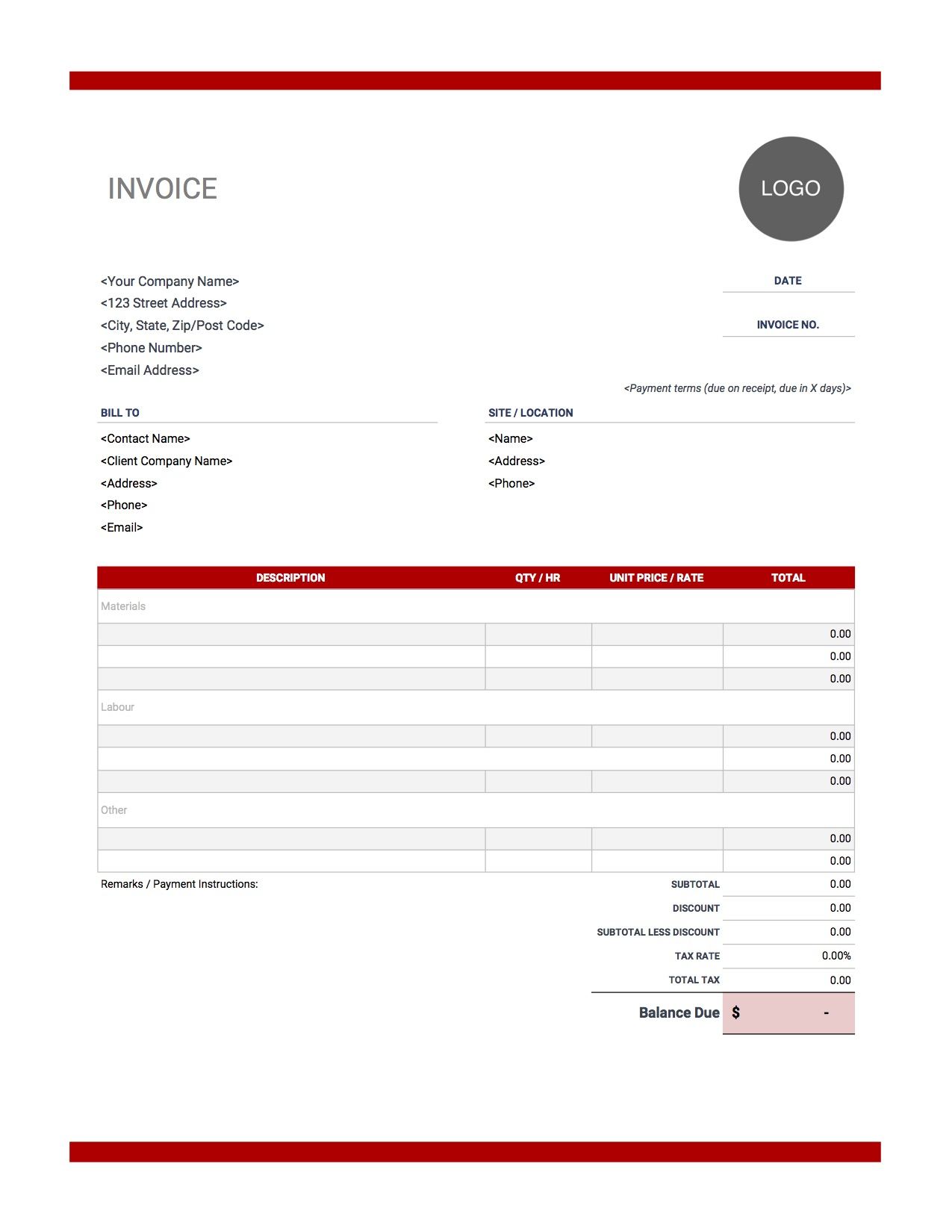

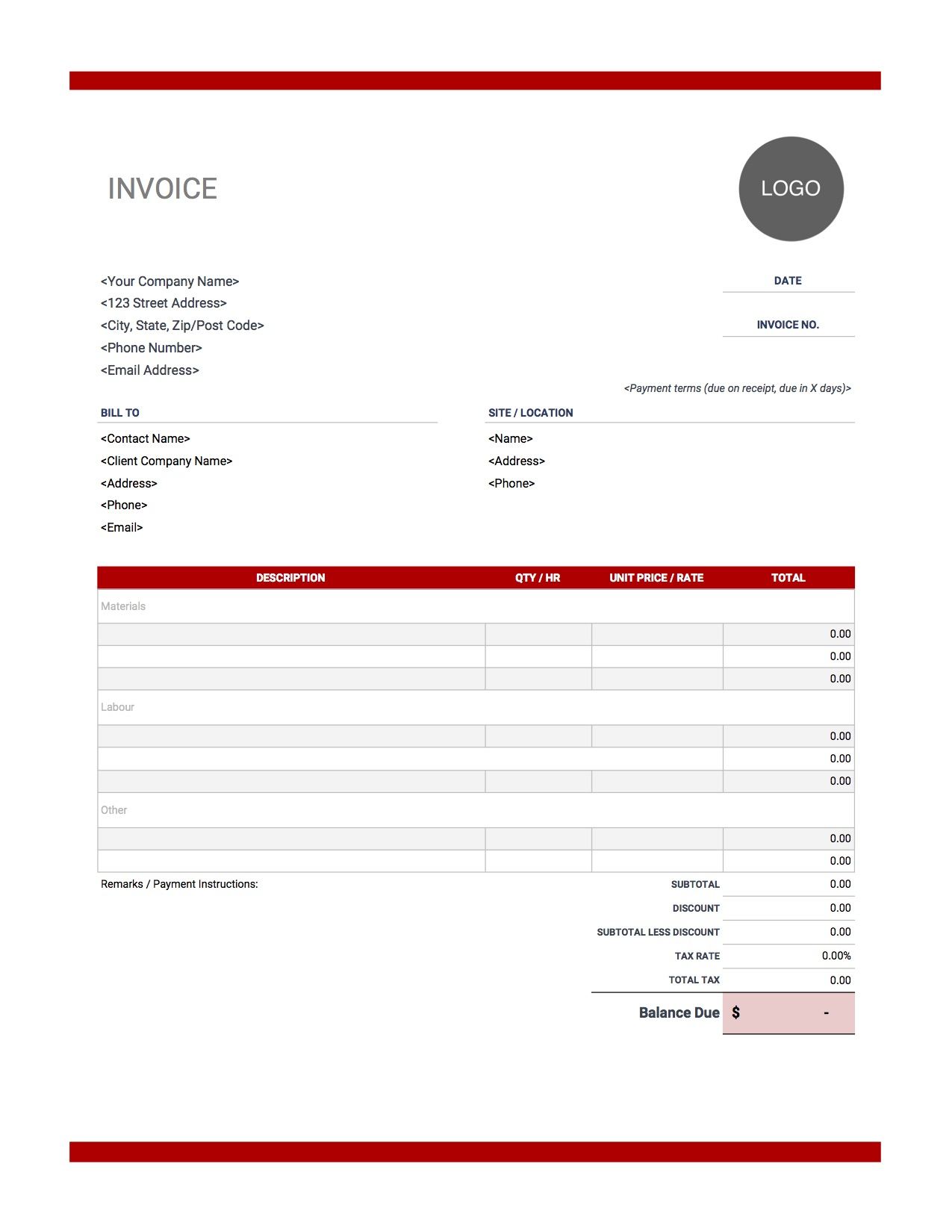

Contractor Invoice Templates Free Download Invoice Simple

Free Contractor Invoice Template Download Now Freshbooks France

Free Freelance Independent Contractor Invoice Template Pdf Word Eforms

7 Independent Contractor Invoice Templates Pdf Word Free Premium Templates

Comments

Post a Comment